Projected Wealth Accumulation

Here's what your investment could grow into across different asset classes.

Achieve your financial aspirations with tailored investment strategies and expert advice, ensuring a clear path to your financial goals

Get the latest update about wealth ✨

Explore a wide range of trusted investment and protection products for every life goal

We offer 100% transparent, honest, and client-first financial solutions

Empowering your financial journey with smart, tech-driven tools for tracking, planning, and investing

Get personal, prompt, and professional support at every step of your financial journey

We are an AMFI-registered financial distributor of mutual funds and other financial products, with vast experience in the financial industry and a large number of satisfied investors.

We offer a complete range of financial products and insurance on a single platform, helping and guiding you to choose the right financial products to successfully achieve your financial goals.

Our comprehensive online smart wealth management platform empowers you to have access to your entire wealth portfolio across Mutual Funds, Direct Equity, Fixed Deposits, Insurance etc at a single place.

Our mutual fund products offer a diversified range of investment opportunities tailored to suit your risk appetite and financial aspirations.

Do not make the mistake of delaying your investments for this most important goal of your life

Start Early, Retire Peacefully – Small SIPs today can build a strong retirement corpus tomorrow.

Stay Ahead of Inflation – Smart investing protects your future lifestyle.

Live with Dignity & Freedom – Retire without financial stress or dependency.

The cost of higher education is increasing annually by more than 15%. It is important that you plan your child’s education well in advance

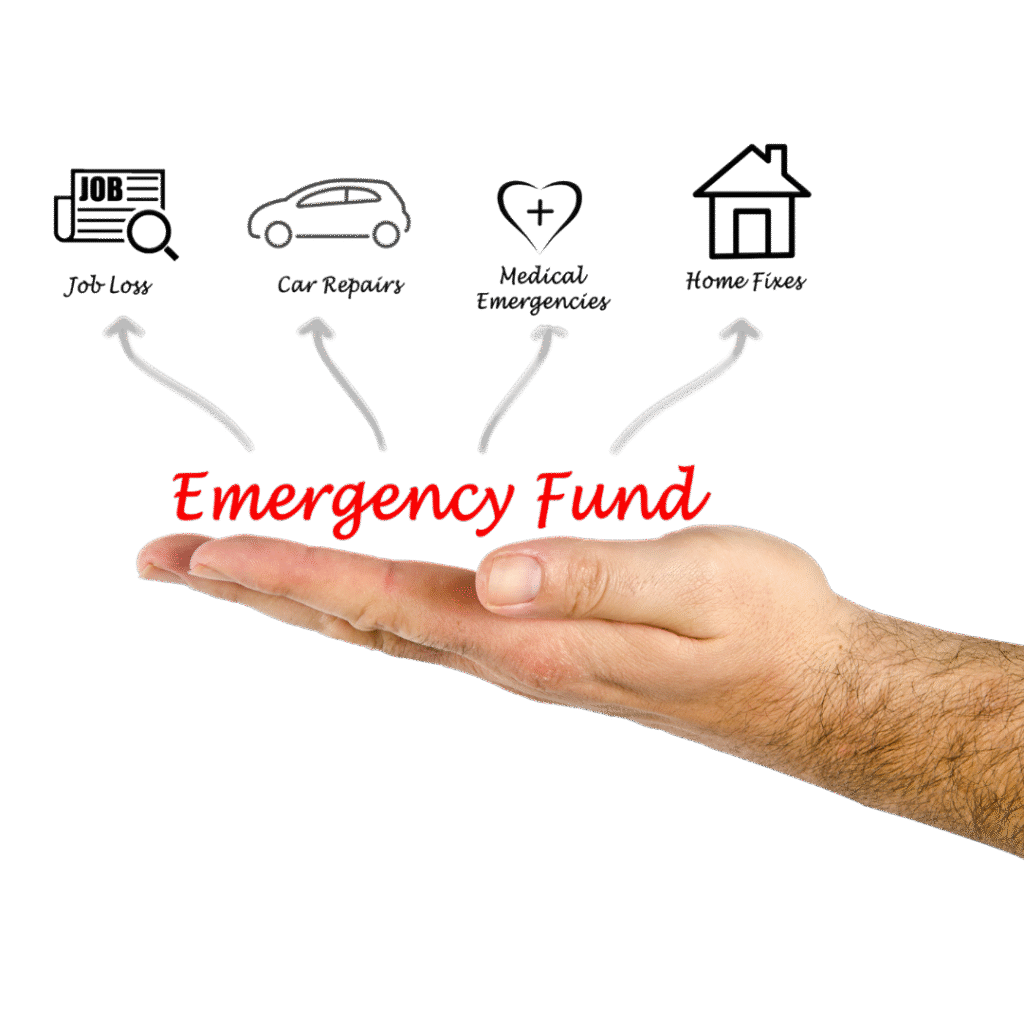

This is the most important goal but ignored by most of us due to lack of knowledge

Who does not want an abode of their own. Start planning based on when you want to have your wealth creation

Who does not want an abode of their own. Start planning based on when you want to have your Sweet Home

By starting with a small SIP amount, you can benefit by power of compounding to meet this goal

Project the future value of your monthly investments over a 25-year period.

Use the slider to adjust your monthly contribution.

Here's what your investment could grow into across different asset classes.

We offer the following value-added services when you make your investments through us!

Founder, Sankalp Enterprises

"They helped me identify and address the key challenges I was facing, implemented effective strategies that led to remarkable results. Thanks to their dedication and expertise."

CEO, Bright HR Solutions

"Managing my finances has always been a challenge for me, but this money management changed my financial situation. They manage my wealth, make comprehensive plans and more."